-------------- 게시물 --------------

Q&Me – market research firm has run a survey recently about Vietnamese washing powder / liquid brands preference. It was conducted among 600 Vietnamese female nationwide from 16 to 49 years old. We figured out how Vietnamese.

Vietnamese clothes washing customs

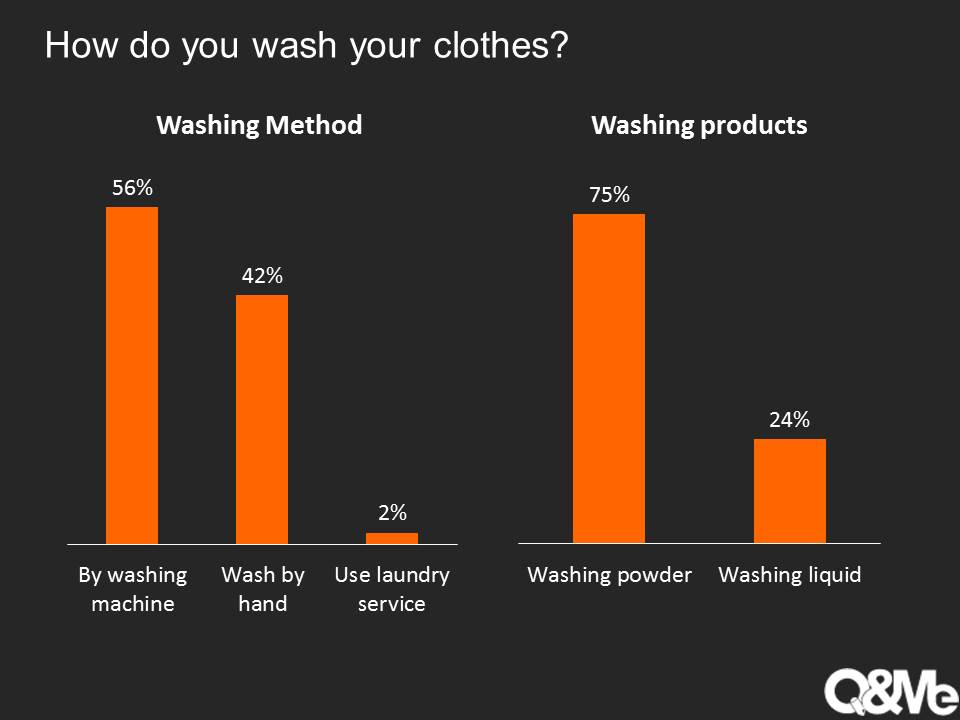

65% of Vietnamese wash their clothes every day and most of them are using washing machine. However, there are still 42% people wash clothes by hand only or before input those to washing machine. In addition, washing powder is the most common product to use for clothes washing.

Omo is the most common used product nationwide

Vietnamese washing powder market used to be the competition of Unilever and P&G for a long time. Since 2012, the new entrance of some domestic products did change the situation which made the market became more active.

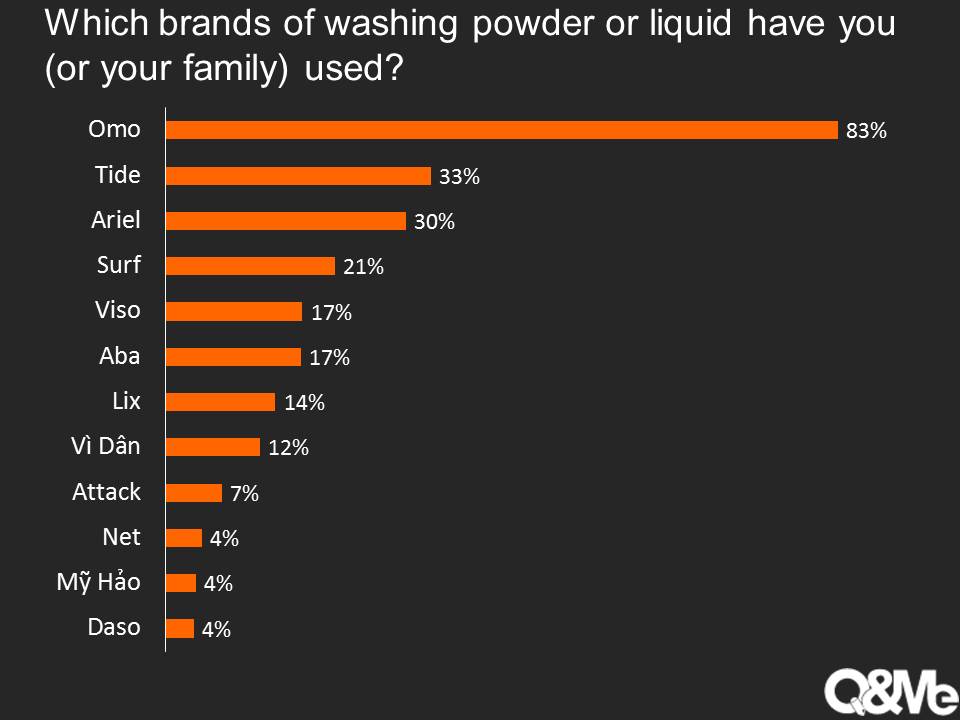

However, currently Omo from Unilever is still the dominant which overwhelm other competitors for the brand experience with 83% people said that they have used this product at least once. Other brands from Unilever such as Surf, Viso also play good roles in wining consumers’ experiences.

P&G with Tide and Ariel are placing at the 2nd and 3rd in the ranking. Surprisingly, some domestic brands such as Aba and Lix are getting more market share despite of late launching.

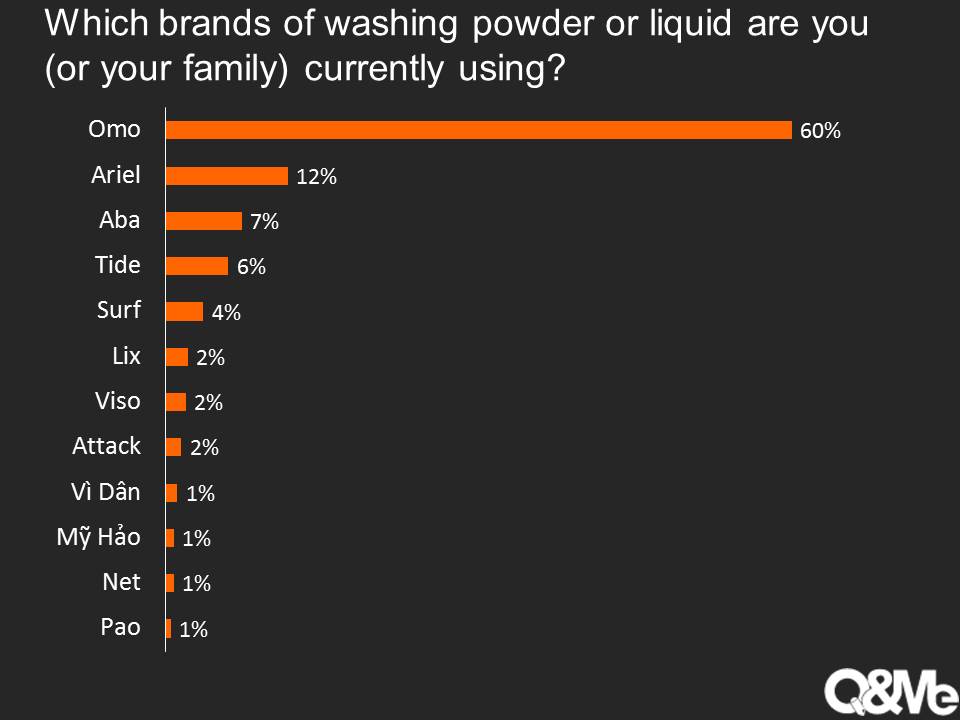

Consumers’ choice of current using is somehow different from their experiences. Besides the number one product still belongs to Omo with 60% market, Ariel is the follower with 12% currently user; then comes Aba (7%) – from Vietcos – a domestic brand with the same target at high segment with Omo and Ariel. Next one is the group of products target at lower segment which are Tide, Surf, Lix and Viso accordingly.

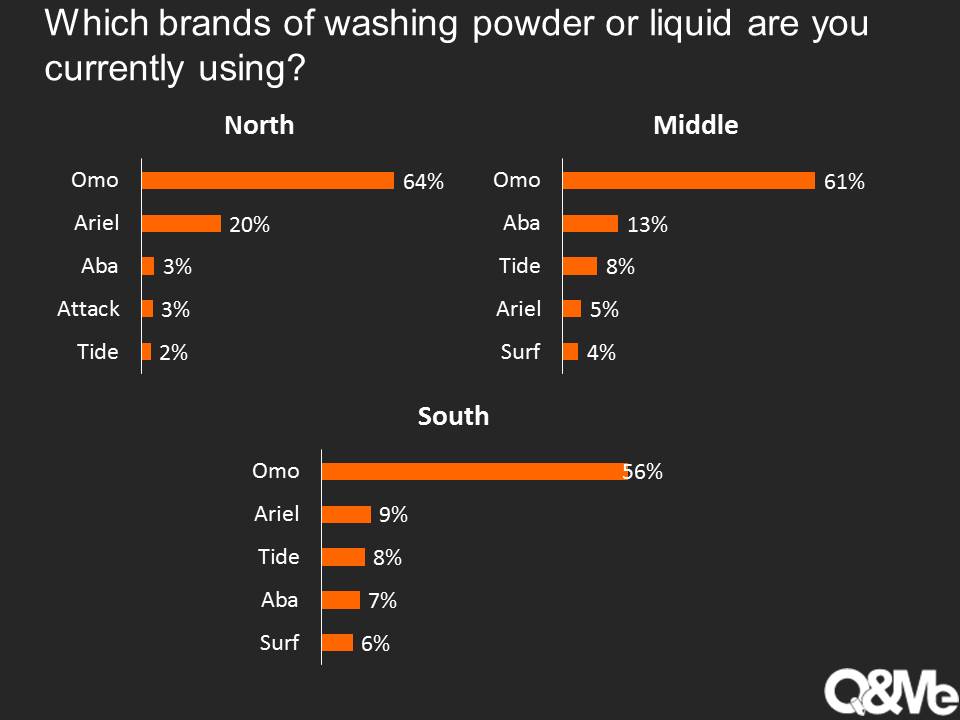

When analyzing by areas, the share portions of brands are different from the North, Middle and South. Omo is the trusted brands which are common used for all areas. Ariel plays better role in the North (20%) and the South (9%) while Aba is more preferred in the Middle (13%) although its marketing plan focuses more on Mekong Delta River. In the North, there is a new player – Attack from Japan with 3%.

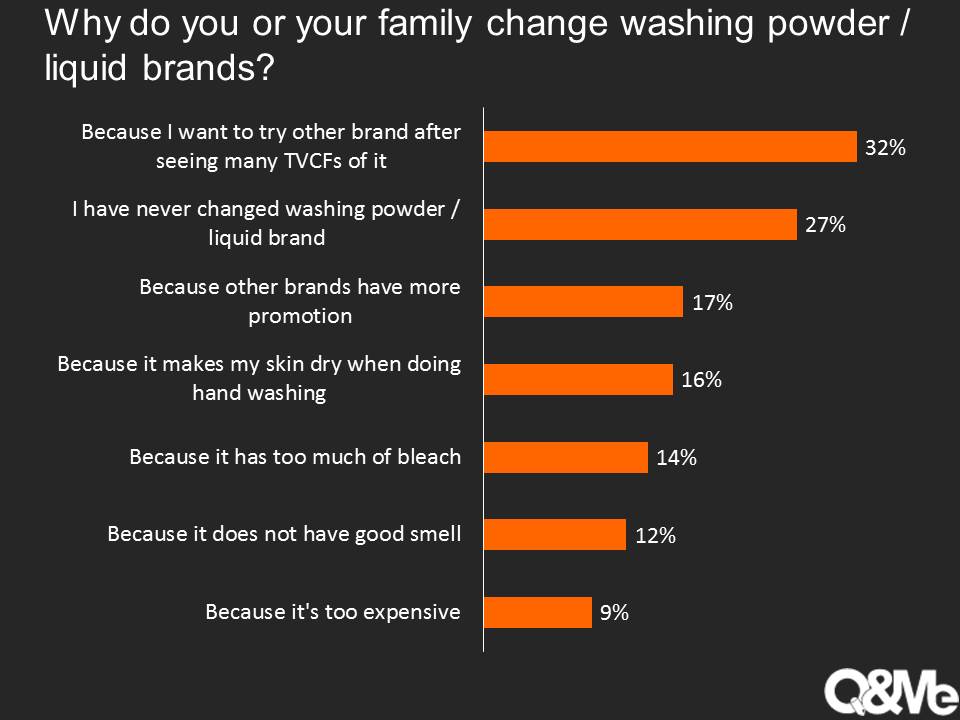

People change to other washing powder / liquid brands after seeing TVCFs

Although there are 27% people are loyal with their current products, 33% wants to try other brands after seeing TVCFs. Not so surprise when all the brands are investing billions in marketing their brand since the market is somehow saturated. Consumers also change the product if other brands have more promotions.

In addition, some voices from users for brand to consider such as they do not like a product which makes their skins too dry because they sometimes wash clothes by hand or the products somehow contain too much bleach which consumers do not prefer.

Q&Me는 귀하의 비즈니스가 베트남에서 성공할 수 있도록 귀하에게 최상의 베트남 소비자 트렌드와 인사이트를 제공하는 베트남 시장 조사 서비스입니다.

저희 첨단 기술을 사용하여 양적인 면이나 질적인 면에서 모두 만족스러운 온라인 설문조사를 실시하여 고품질의 베트남 시장 데이터를 합리적인 가격으로 제공할 수 있습니다. 저희 서비스에서 온라인으로 채팅을 통한 설문 조사인 그룹 인터뷰도 진행할 수 있어 출장을 가야 하는 번거로움을 줄일 수 있습니다. 현재 Q&Me는 조사 참여자를 직접 관리하고 있으며 귀하에게 필요한 정보는 즉시 귀하에게 전달됩니다.

베트남 시장에 대한 조사가 필요하시면 저희에게 연락해 주시기 바랍니다. 귀하와 연락하여 저희는 매우 기쁘게 생각합니다. 베트남에서 귀하의 비즈니스 성공을 도와드리겠습니다.문의